Take Away the Frustrations of Workers’ Comp & Payroll Management

Words: Mary Van Keuren with Sean Nybank, Hourly.io

Photos: Hourly.io

Working with his family’s real estate

development company, Tom Sagi knew all about the complications of meshing his

hourly payroll with estimated workers’ compensation premiums. It was a hassle

he didn’t need—so he decided to do something about it.

Having one place for organization is pivotal in contracting companies, whether it be managing five employees or 50. Providing a new way to achieve cost savings on the job while eliminating one of the more tedious tasks of business ownership can be accomplished with the right software and the right tools.

Know Who’s Working Where

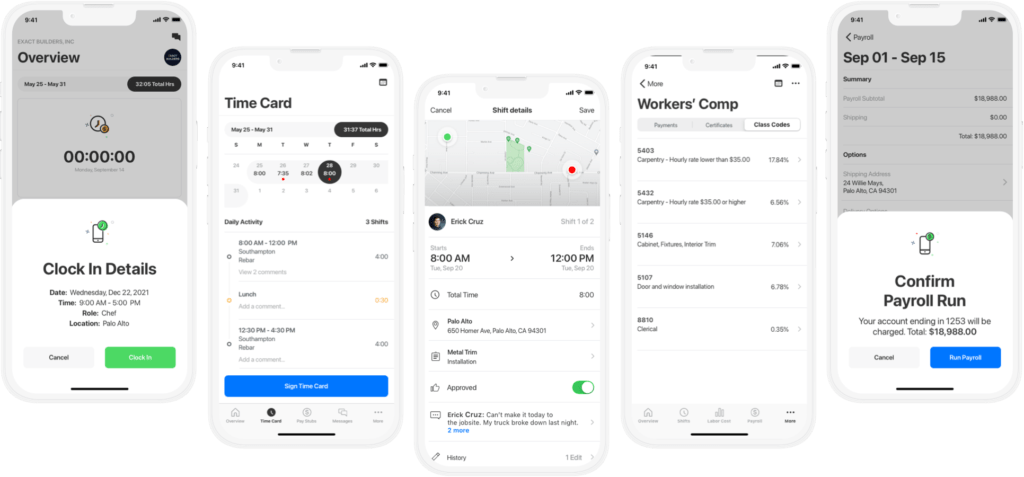

Choosing the right software starts with defining what you need it to accomplish. One of the key points can be knowing who is working where by taking simple steps. With this tool, users can have the opportunity to see how many workers are currently at each job site and what jobs are operating at the time. Another key component in using software to keep track of employees and payroll, is to be able to have the platform work across different hardware. For example, working on a desktop, laptop, phone, or tablet across iOS and Android devices.

The Paper Punch Becomes a Digital Punch

When assessing payroll, it is usually determined by a paper punch-in sheet. Digitization of this tracking can change the flow of employees, leaders, and owners to allow for seamless integration. When employees clock in, some features make a difference in their experience. Employees may be able to track the hours that they have worked, what job responsibilities were accomplished, approve a payroll, and send messages to their supervisor. With these digital tracking tools, employee time management and payrolls can be easy.

Real-Time Intel on Labor Costs

For managers and owners, moving towards digitalization means on-demand estimates and processes. Using a system to track payroll allows an admin user to track total labor costs on each job, representing labor, taxes, workers' comp, and much more. If there are any over-budget predictions, let's say if someone is working too much overtime, it is important for the software to be able to notify you in order to stay on track with your budget.

Payroll is a Snap

Payroll

can be a pain, even if it is tracked through software. With the right tools, a

company can view each employee and job site, and filter by hourly and salary.

Moving to a digital platform removes the need for payroll slips, texts, calls,

and punch cards. All data is stored in one place, allowing management to save

hours on organization, mailing, and verifications. Many time cards may not be

completely accurate in the way that some employees clock in before arriving or

clock out after leaving. This issue usually does not make a noticeable

difference until more employees continue to do it, potentially costing a

significant amount annually. With the digitalization of time tracking,

employees can only clock in and out while they are GPS tracked on/off a job

site.

Depending on your state, running payroll requires tracking your taxes throughout each issued check. Moving to digital integration allows for all taxes, including employee and employer, to be automatically set aside and emptied periodically with the state of your company. The seamless integration continues to be pivotal as data should be able to be exported in any format with the necessary data for whatever program or other software is being synched. In certain cases, synching software and platforms can be set to automatic, so there is no need to export data at all.

Workers' Comprehensive Insurance With No Estimates

When paying workers' compensation, many business managers will have to spend hours organizing the policies, amount, codes, and more. With software integrations, class codes can be accessed, as well as the wages spent in each of these codes and the amount of the premium submitted for each code. When a normal payroll is run, the payment happens automatically and is not based on estimates. Rather, the payment is exact to the penny, leading to no risk of paying too much or too little.

Owners don’t have to deal with multiple spreadsheets for payroll and premiums; it’s all integrated into one format. And with that format comes increased transparency that allows the user to monitor in as fine detail as needed the financial workings of the business.

Making the Switch is Simple

Making the switch to digital payroll tracking can be easy. Many platforms have resources and teams available to assist in any way and can assist in onboarding.

About Hourly

Hourly is an insurtech startup offering workers’ comp insurance and full-service payroll for small and medium businesses with hourly workers. With all of these features, Hourly's team is always willing to assist in the process of moving to digital software. At Hourly, Sean Nybanks says, “People say, ‘Wow, that’s so easy. It ends up being an easy conversation for everyone.”

Visit Hourly’s website for more information.