December 2011: Government Affairs

Words: Dan Kamys

Government Affairs

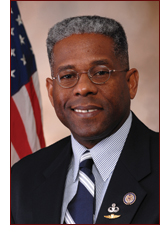

By Congressman Allen West

By Congressman Allen West

On Sept. 8, President Obama delivered his jobs agenda speech to a joint session of the United States Congress. I commend President Obama for finally making jobs his top priority after more than 33 months in office. However, I was disappointed the American Jobs Act appears to be nothing more than a stimulus “mini me,” with increased Federal Government spending that will further deepen our debt and deficits. Our national debt already is more than $14.5 trillion, and our deficit still is projected to be more than $1 trillion in Fiscal Year 2012.

The President has increased the federal debt by nearly $5 trillion since taking office, and, with historic levels of excessive spending, has created record deficits of $1.42 trillion, $1.29 trillion, and $1.65 trillion in the last three fiscal years. As a result, more than 41 cents of every dollar spent is borrowed, and 47 percent of our federal debt is owned by foreign nations.

Apart from defense, federal spending traditionally has hovered around 16.5 percent of total GDP since 1980, through both Democrat and Republican administrations. But under President Obama, non-defense spending is soaring to 23 percent of GDP this year, and will remain at historically high levels in the future.

When President Obama urged passage of the original stimulus bill in 2009, he and his economic advisers insisted it would keep unemployment below 8 percent.??On the contrary, unemployment has hovered at or above 9 percent for the last two years, and the President seems to think more of the same failed policies will somehow solve our employment problems.

In his recent speech, the President repeatedly insisted this new plan was paid for and would not rely on more borrowed money. Instead, he plans to task the Select Committee on Deficit Reduction with finding additional savings on top of the $1.5 trillion in cuts it had to find and propose in November.

Further, and more ominously, the President plans on raising taxes on our American job creators. During a time of economic downturn, when we are trying to spur job growth and the growth of our small and large businesses, the addition of burdensome taxes is the last thing we need.

American businesses pay the second-highest corporate tax rate in the world. I agree with cutting the corporate/business tax rate down to 21 percent, and eliminating all tax loopholes and subsidies – something I have championed since before being sworn into Congress. Many businesses are shipping their American jobs overseas in an attempt to escape this large tax burden and become more globally viable. A reduction of this tax rate will make businesses more competitive on a global scale, return overseas jobs to the United States, and bring capital back to our shores to produce more goods and services, increase our tax base and hire more Americans.

I agree with President Obama that we need tax credits for small businesses, which is why earlier this year, I introduced the Small Business Encouragement Act, H.R. 1663, giving up to a $12,000 tax credit for each hire off the unemployment roll. I also agree with President Obama that we need to create a job opportunity for our returning veterans, which is why I have co-sponsored several pieces of legislation in the House of Representatives, including the Military Spouses Employment Act, the Veterans Opportunity to Work Act, and the Hire a Hero Act.

Along with reviewing and rolling back regulations, President Obama has recommended several ideas the House of Representatives already has been working on – ideas that Democrat leadership in the United States Senate refuses to consider.

It is my sincere hope that President Obama and the Democrat-controlled Senate will recognize the efforts of the House of Representatives and work with us to keep the government from standing in the way of American innovators, entrepreneurs and job creators.

After all, there can be no business owner who will tell you more regulation, more bureaucracy, more market interference and more taxes can possibly be better for business. The best thing our government can do to stimulate the economy is simply get out of the way.

Return to Table of Contents